Iranian-Iraqi Businessman Charged, Sanctioned in Scheme Involving Purchase of Oil Tanker

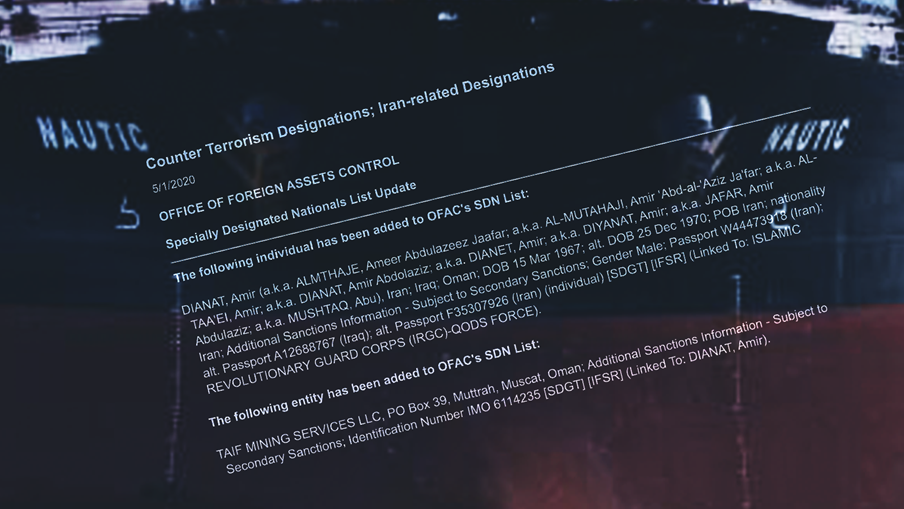

The U.S. on Friday imposed sanctions and filed criminal charges against a businessman with ties to senior officials of Iran’s Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF), accusing him of helping Tehran procure an oil tanker.

Create your free account or log in to access exclusive content.