By Kharon Staff

September 11, 2019

Sanctioned Russian billionaire Viktor Vekselberg has lowered his stake in, or divested completely from, several companies he previously majority owned.

Past and current managers of Vekselberg’s Renova Group have taken over the shares in multiple cases, according to a Kharon review of corporate records. The nature of these asset transfers raises questions about Vekselberg’s relationship with the companies, some of which have said in press statements that the sanctions caused problems for business.

Assets majority-owned by a sanctioned party are automatically blocked under the U.S. Treasury Department’s “50 percent rule.” Despite divestment, “the control risk is still there for a future designation” if Vekselberg still controls the company even if he has lowered his stake below 50 percent, said Cari Stinebower, a partner at the law firm Winston & Strawn LLP who previously served as counsel to the Treasury’s Office of Foreign Assets Control (OFAC).

The 50 percent rule only concerns ownership, not control, according to OFAC guidance: An entity controlled, but not majority-owned, isn’t automatically blocked by the rule. However, OFAC can designate an entity “over which a blocked person exercises control,” the guidance says. OFAC “urges caution” when considering transactions with an entity not under sanctions but minority-owned or controlled by a designated person without a majority interest.

“Such non-blocked entities may become the subject of future designations or enforcement actions by OFAC,” the guidance says.

Vekselberg and his company Renova Group were among those designated in a sweeping April 2018 sanctions action characterized in media reports as one of the “toughest” measures taken by the Treasury against Russia. In that effort, the U.S. sanctioned some of the country’s most prominent businessmen, who, including Vekselberg, held major interests abroad.

Vekselberg told the Financial Times in June that the sanctions were “a total crisis of my life.” OFAC “wants to create trouble for Russia … But instead they create trouble for international companies and countries,” he said.

Andrew Intrater, a cousin of Vekselberg, filed a lawsuit in July challenging the constitutionality of the 50-percent rule because investment funds he runs were blocked due to the sanctions on Vekselberg. The Treasury has until mid-September to respond to the Intrater lawsuit, according to the court docket.

Oleg Deripaska, a Russian oligarch who was also sanctioned in the April 2018 action, struck a deal with the Treasury that led to the delisting of several of his companies, including aluminum giant United Company Rusal PLC, after significant restructuring of the companies’ ownership, board and executive management. He is seeking similar treatment for GAZ Group, another major holding, Kharon reported.

Vekselberg, rather than waging an extensive public campaign over the designation of his companies, has sold or transferred the corporate structures to high-level officials at Renova or to other people close to him, Kharon found.

CZECH PRECIOUS METALS COMPANY DIVESTMENT

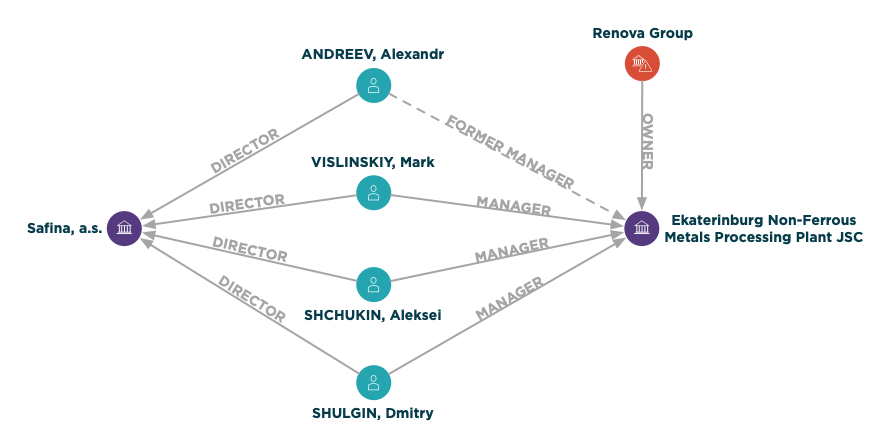

Vekselberg, from 2014 until March 2019, held an indirect majority stake in Czech precious metals refining company SAFINA a.s. The board of directors of SAFINA, however, remains tied to Vekselberg corporate structures, even after the divestment.

A little-known limited liability company in Russia named Best Company OOO acquired a majority of SAFINA’s shares in March.

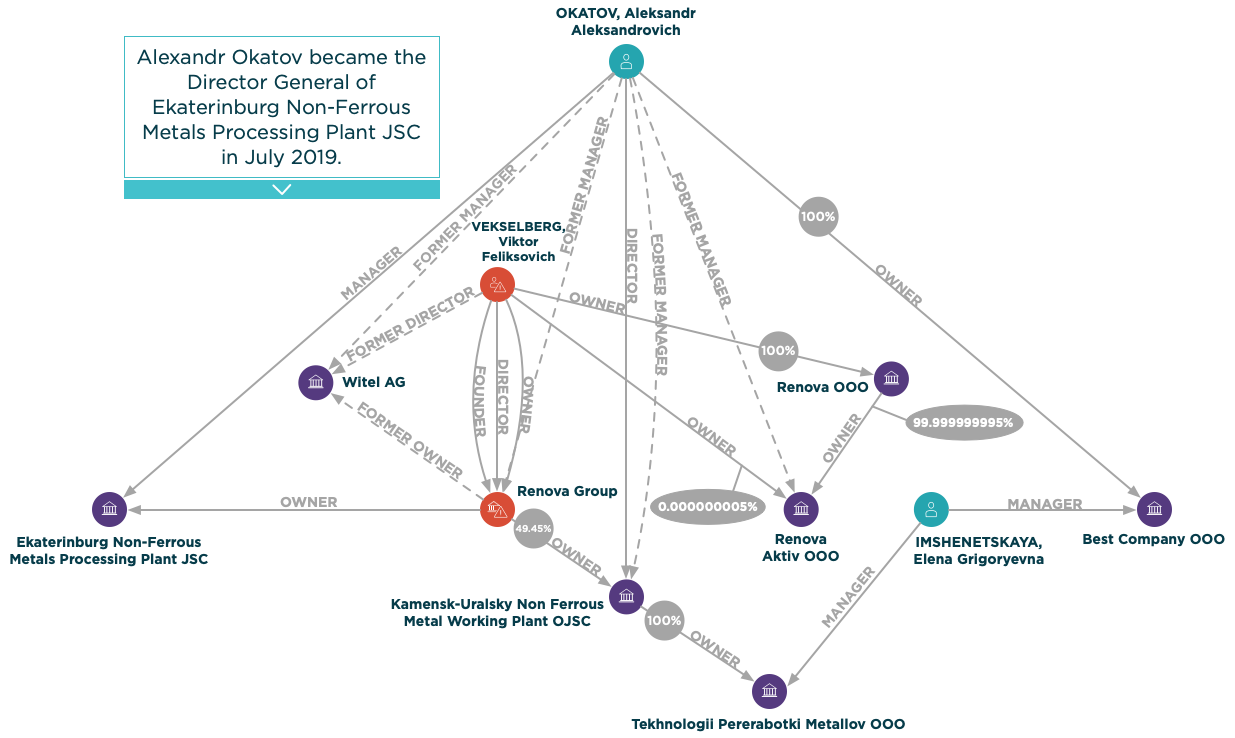

Since its founding in June 2018, Best Company has been wholly owned by Aleksandr Aleksandrovich Okatov, who has served in leadership roles of Renova companies since at least 2009. Elena Imshenetskaya, the director general of Best Company, has also served in an executive role at one of Renova Group’s subsidiary companies.

SAFINA is the largest industrial processor of precious metals in Central and Eastern Europe, according to Czech media; the company itself touts on its website of having “significant influence” in European, North American and Asian markets.

The 2014 acquisition of SAFINA by the Russian oligarch was not seen as a surprise, as media reports noted that Vekselberg already held assets in the metals business at the time. He has held a majority stake since 2004 in Russia-based Ekaterinburg Non-Ferrous Metals Processing Plant (EZOCM), which worked closely with SAFINA before Vekselberg’s acquisition of the company.

As a result of the companies’ close collaboration, EZOCM registered the Plarum brand trademark in coordination with SAFINA; the companies continue to operate under this trademark umbrella.

Local media called SAFINA “the first Czech victim” of U.S. sanctions in Czechia following the designation of Vekselberg. Several domestic banks closed SAFINA’s bank accounts as a result of the new restrictions.

SAFINA posted losses in 2018 total revenue and EBITDA, or earnings before interest, tax, depreciation and amortization, according to Czech media, citing 2018 annual earnings. However, SAFINA management told local media that U.S. sanctions have not had a major impact on the company, and that it continues to be profitable.

SAFINA wholly owns a Texas-based subsidiary, SAFINA Materials, Inc. SAFINA said in a June 2019 statement that the company’s business in the U.S. suffered due to sanctions. Speaking about Vekselberg’s divestment from SAFINA, the company said in a press statement that SAFINA “has been automatically dropped out of the sanctions regime, and the company has normalized its relations with the banking sector.” SAFINA has begun taking steps to reopen its U.S. branch, the company said.

THE COMPLEX MAKEUP OF COMPLEXPROM

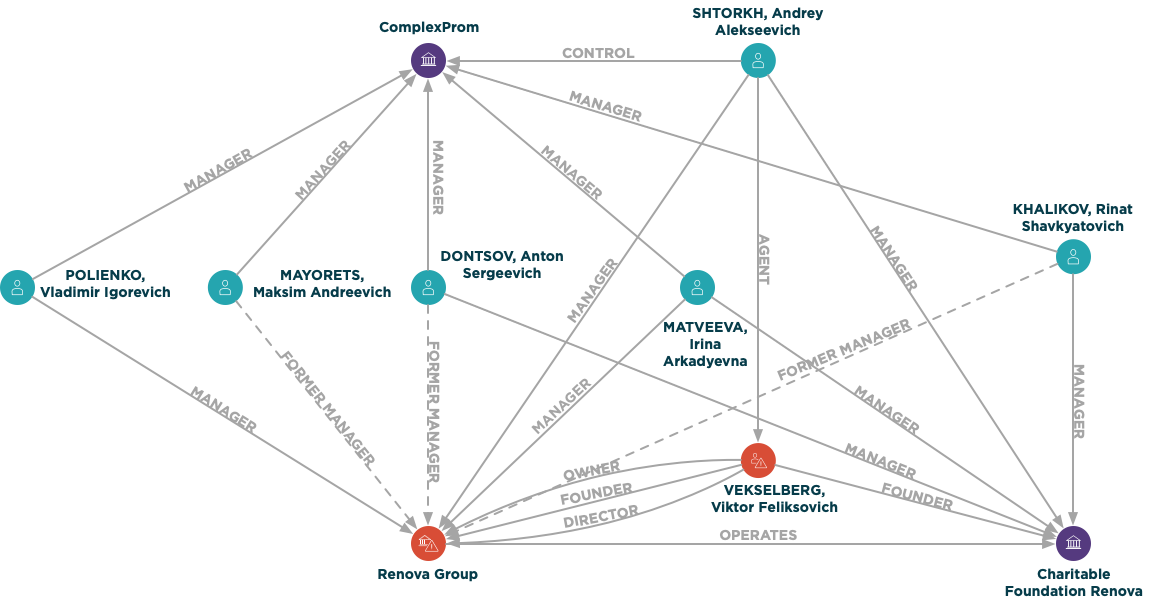

A few months after he was designated, Vekselberg began divesting some of his holdings and transferring the shares to ComplexProm, a Russian private consulting firm.

Since 2018, Vekselberg has transferred key stakes in companies involved in infrastructure, real estate development, metalworking and agriculture to ComplexProm.

The company was not well-known until June 2018, when Renova transferred his shares in the Swiss Witel AG, formerly known as Renova Management AG, to ComplexProm. ComplexProm doesn’t disclose its ownership, but the company’s website reveals some corporate details. Among them: The company shares an address listed by the U.S. for Renova Group, and several of its managers are on the board of a Renova-operated charitable foundation.

In addition, top managers of ComplexProm are current and former executives at Renova, according to ComplexProm and Charitable Foundation Renova websites.

ComplexProm is involved in managing “strategic shareholdings of a number of Russian enterprises,” focusing on infrastructure and technology projects, it said on the website.

Infrastructure & Real Estate Development

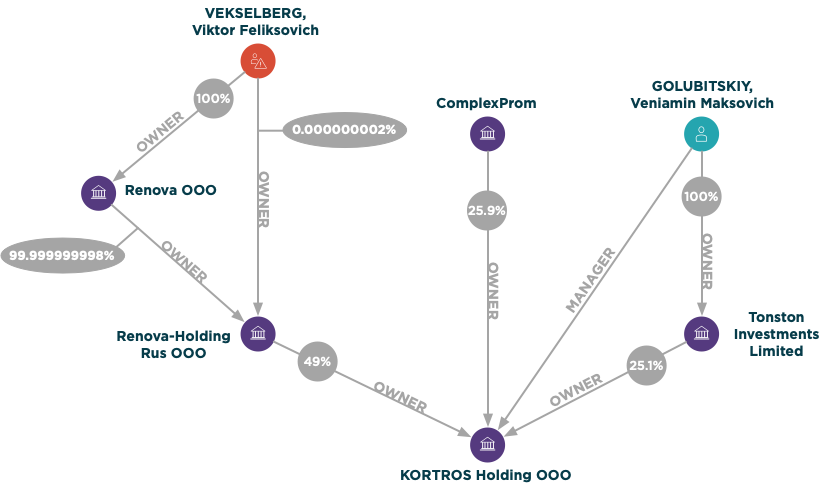

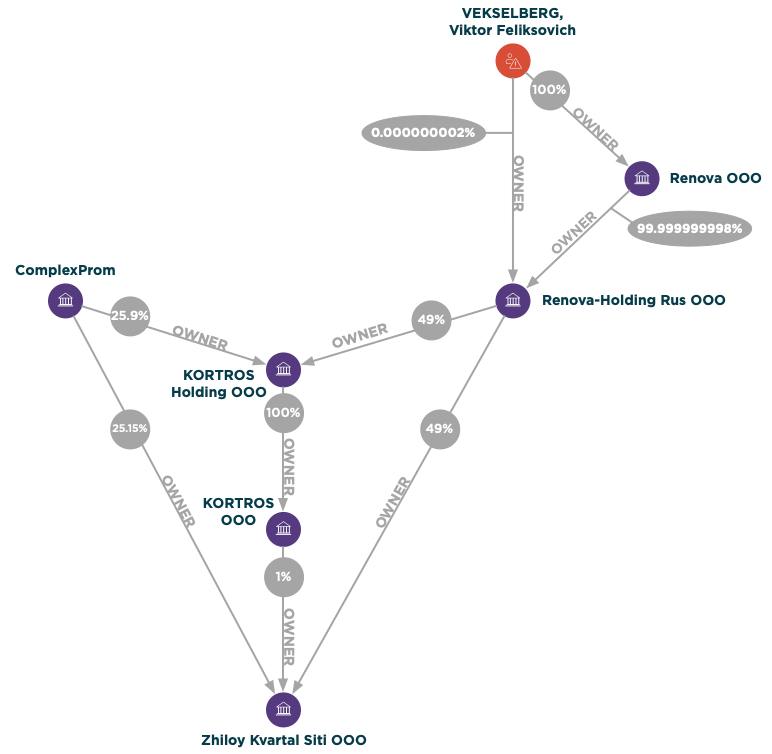

ComplexProm acquired about a quarter of Russian federal construction development company KORTROS in March 2019 when companies majority owned by Vekselberg lowered their stake in KORTROS to 49 percent, down from 74.9 percent.

KORTROS, which is included in the top 20 list of developers by the Russian Unified Register of Developers, operates in eight regions of Russia, employing over 600 workers. One of KORTROS’s largest ongoing projects is the development of the Akademicheskiy District in Ekaterinburg, which the company calls the “largest urban development project in Europe.”

When completed, the Akademicheskiy District is expected to span 1,300 hectares, with more than 325,000 residents.

The Akademicheskiy District is primarily aimed at providing affordable housing, but KORTROS is also in the process of building a luxury complex in Moscow called Headliner, comprised of 10 highrises. Russian company Zhiloy Kvartal Siti, the developer of the project, works closely with KORTROS. Vekselberg’s wholly owned companies lowered their stake in Zhiloy Kvartal Siti in late 2018 to under 50 percent, down from 74.9 percent.

The flagship building of the Headliner complex will be a 53-story tower, which like the other buildings in the complex, will be equipped with smart home solutions. Headliner is meant to attract young people of certain social status, according to Russian media. The Headliner is expected to be completed by 2026, but apartment presales are already available.

KORTROS president Veniamin Golubitskiy told reporters prior to the Vekselberg drawdown that U.S. sanctions do not impact the business because materials and financing for the Russian construction sector come primarily from domestic sources. A KORTROS subsidiary established to attract external financing for its parent said in quarterly earnings statements that it didn’t expect sanctions to have a significant impact on its financial statements.

However, Renova asked the Russian government in May 2018 for KOTROS to receive preferential treatment, according to a report in the Russian media outlet Kommersant. One proposal called for KORTROS to serve the housing needs of the Ministry of Defense, in part by selling the government apartments in Ekaterinburg’s Akademicheskiy District. When reporters pointed this out to Golubitskiy, he denied asking for state support and said that KORTROS won the tender to sell housing to the ministry through а fair procurement process.

A fund managed by a subsidiary of state-owned VTB Bank, which is subject to U.S. restrictions on the Russian financial sector, purchased 31 apartments at the Headliner apartment complex in August for an estimated value of RUB 420.8 million (over USD 6.4 million at the time).

Metalworking

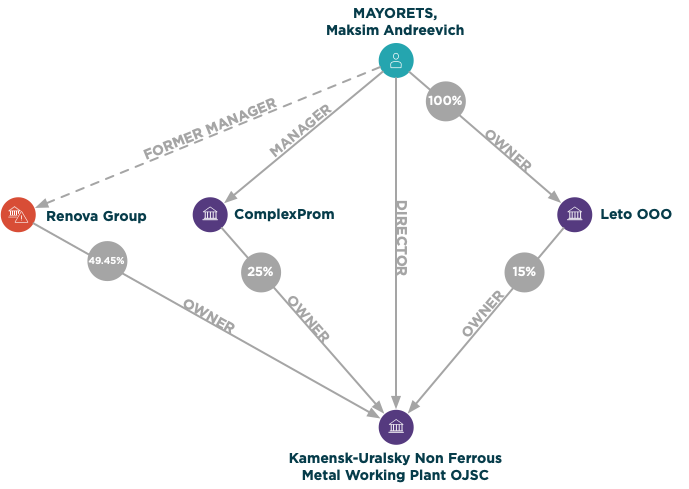

Renova reduced its stake in Kamensk-Uralsky Non-Ferrous Metal Working Plant (KUZOCM) to 49.45 percent in October 2018, down from 89.45 percent. The company produces a wide range of metal products that are used in all industries, according to KUZOCM’s website. ComplexProm received 25 percent of the shares transferred from Renova, records show.

KUZOCM imports and exports products to and from European and Chinese firms. Unlike KORTROS, KUZOCM’s management was quiet about the effect of the U.S. sanctions on the company, but export data for KUZOCM shows a marked decline after the Renova designation.

KUZOCM received two loans in August 2018 totaling nearly RUB 1.6 billion (roughly USD 23 million) from Gazprombank, another lender subject to U.S. restrictions against the Russian financial sector. Though the details of the loans were not revealed, the total amount exceeded one-third of the value of company’s assets, according to local media reporting.

KUZOCM’s business development plan for 2018 mainly focused on attending Russian and international trade fairs. The campaign was aimed at not only attracting new customers, but also expanding the geography of sales, according to a Metal-Expo press release. KUZOCM won “Industry Exporter of the Year” and “New Geography” awards at this year’s International Industrial Fair (INNOPROM), held in July in Ekaterinburg, Russia.

Samuel Rubenfeld contributed to this report.